Deciding between a physical gold investment and traditional physical gold can be a tricky task for investors. Both options offer the chance to protect your portfolio against market instability. A Gold IRA allows you to invest in gold within a tax-advantaged investment account, while physical gold provides direct ownership of the asset.

- Considerations to Analyze When Choosing:

- Portfolio Objectives

- Tax Implications

- Liquidity Needs

- Storage and Security Concerns

Understanding these factors can help you determine an informed decision that best aligns with your individual needs. Ultimately, the best choice depends on your personal financial goals and risk tolerance.

Gold IRA vs 401(k): A Retirement Investment Showdown

Planning for retirement is daunting, but choosing the right investment vehicles can make all the difference. Two popular options are the Gold IRA and the traditional 401(k). While both offer advantages, understanding their key differences is crucial to making an informed decision. A Gold IRA allows you to invest in physical gold, potentially protecting your portfolio against inflation and market volatility. On the other hand, a 401(k) is a retirement savings plan sponsored by employers, offering potential tax benefits and employer contributions. Factors such as your risk tolerance, investment goals, and time horizon when comparing these options.

- The most suitable option|depends on your individual circumstances.

Exploring the Potential of a Gold IRA: Pros and Cons to Consider

A Gold Individual Retirement Account (IRA) presents an attractive opportunity for investors seeking protection within their retirement portfolio. By investing your funds into physical gold, you can hedge against market volatility and inflation. However, before diving into the lucrative world of Gold IRAs, it's crucial to thoroughly weigh both the advantages and inherent drawbacks.

- A key advantage of a Gold IRA is its potential to safeguard purchasing power during periods of economic instability. Gold has historically served as a store of value, withstanding the erosion caused by inflation.

- Furthermore, a Gold IRA can deliver diversification benefits to your overall portfolio. By distributing a portion of your retirement funds into gold, you can mitigate the impact of market fluctuations.

- Conversely, Gold IRAs do come with certain considerations. Firstly, gold is a tangible asset that necessitates secure storage and coverage. This can lead to fees compared to traditional retirement plans.

- Furthermore, the value of gold can change significantly over time, making it a volatile investment. Upon considering investing in a Gold IRA, it's essential to consult with a financial advisor your financial situation.

Discover Top-Rated Gold IRAs: Find Your Perfect Investment Match

Are you seeking a reliable way to diversify your retirement portfolio? A Gold IRA could be the answer. Gold has historically been a valued asset of value, and an IRA provides tax advantages for long-term growth.

Consider the top-rated Gold IRAs available today and discover the one that best aligns with your investment goals.

- Analyze different providers based on their costs, reviews, and investment options.

- Discuss a qualified financial consultant to assess if a Gold IRA is right for yourselves' individual circumstances.

- Open your account safely and begin building your future.

Delving into the World of Gold IRAs: Key Factors to Remember

Embarking on a path into the realm of Gold IRAs can be both appealing, yet it's essential to chart this multifaceted landscape with caution. Firstly, comprehend the fundamental principles influencing Gold IRAs. Research thoroughly the laws set forth by the IRS to guarantee you're transacting within conformance. ,Moreover, meticulously consider your financial goals and risk tolerance. A Gold IRA may not be fitting for everyone, so matching it with your holistic investment strategy is crucial.

- Opt a reputable and credible custodian. This individual will manage your Gold IRA possessions with precision.

- Diversify your investments across various types of gold to mitigate risk. This strategy can help safeguard your investment.

- Consistently monitor the performance of your Gold IRA. Tweaks may be needed over time to maintain its synchronization with your monetary goals.

Should a Gold IRA Right for Your Retirement Portfolio?

Diversifying your retirement portfolio is crucial, and many investors are exploring alternative assets like gold. A Gold IRA, or Individual Retirement Account, allows you to invest in physical gold, often as bullion or coins, within a tax-advantaged account. However, before making the leap, it's essential to weigh the benefits and cons of a Gold IRA. Precious Gold ira vs 401k metals' historical performance as a hedge against inflation can be appealing to investors, but it's crucial to understand the fees involved and the potential fluctuation of gold prices.

- Consider your overall investment plan.

- Research reputable Gold IRA providers.

- Speak with a qualified financial advisor to determine if a Gold IRA is a suitable option.

Mara Wilson Then & Now!

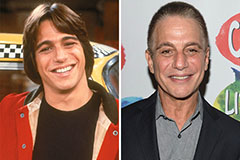

Mara Wilson Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!